There are law slab rates in new income tax rule, and it authorizes little dedication as well, which is main discouragement in following new income tax rule.

In Budget 2020 FM Nirmala Sitharaman has anticipated a new income tax laws with lower income tax slab rates with smaller amount dedication. This new income tax regime will be available with old income tax law and taxpayers are free to choose any one.

Previous income tax rule has 4 tax slabs and new tax regime has 7 slabs of tax

Previous Income Tax Slabs:

|

Tax Percentage |

INCOME |

|

0% |

income up to Rs 2.5 lakh |

|

5% |

income over Rs 2.5 lakh to Rs 5 lakh |

|

20% |

income over Rs 5 lakh to Rs 10 lakh |

|

30% |

income over Rs 10 lakh |

New Income Tax Slabs:

|

Tax Percentage |

INCOME |

|

0% |

income up to Rs 2.5 lakh |

|

5% |

income over Rs 2.5 lakh to Rs 5 lakh |

|

10% |

income over Rs 5 lakh to Rs 7.5 lakh |

|

15% |

income over Rs 7.5 lakh to Rs 10 lakh |

|

20% |

income over Rs 10 lakh to Rs 12.5 lakh |

|

25% |

income over Rs 12.5 lakh to Rs 15 lakh |

|

30% |

income over Rs 15 lakh |

Note: New tax slabs will give the benefit to taxpayers who falls between the income 5 lakh to 15 lakh.

Major dedications under the old rule as follows:

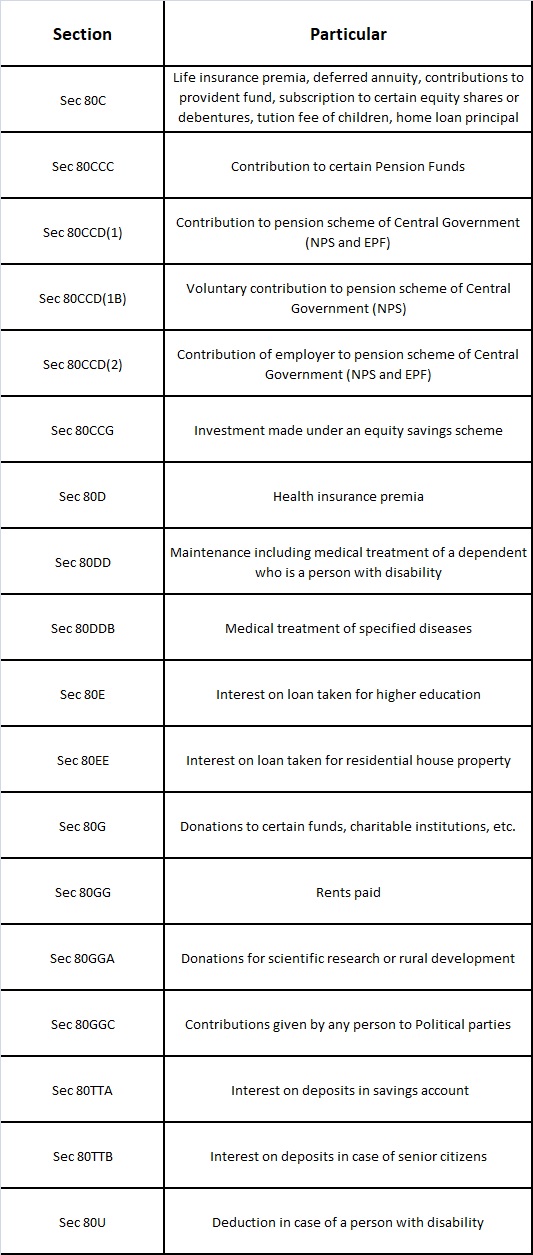

Other major deductions available under Chapter VI-A are:

Subtractions that will not be accessible under new rules are :

Note: Deductions under Chapter VI-A will not be available under the new income tax rules.

Taxpayers who claim that a high number of tax exemptions to get interest on home loan, LTA, HRA, etc. under Section 80C, 80D must better carry on with all the old income tax plan. It’s advised that taxpayers to maintain tax exemptions that were increased are going to have the ability to reap benefits under the tax regime that was new.